You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

RBNZ Maintains Interest Rates, Surprising Markets with Hawkish Stance, Boosting NZD

TOPICSTags: Interest Rate, New Zealand, NZDUSD, RBNZ

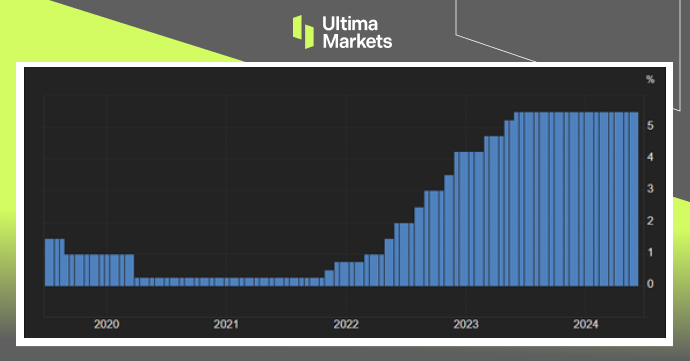

The Reserve Bank of New Zealand (RBNZ) maintained the official cash rate (OCR) at 5.5% during its May meeting, marking the seventh consecutive hold, and signaled a more hawkish outlook than anticipated. Subsequently, the New Zealand dollar surged past $0.612. The RBNZ stated that the current restrictive policy stance is necessary for a longer duration to bring inflation back within its target. Although the country’s annual inflation decelerated to 4% in the first quarter, it is still above the bank’s preferred range between 1% and 3% over the medium term.

The committee emphasized the importance of sustaining the OCR at a high level to achieve the inflation target in a reasonable timeframe. While inflationary pressures from wages and domestic spending are aligning with expectations, inflation persists, driven by rising costs in housing rents, insurance, and other domestic services.

The RBNZ has updated its rate peak forecast to 5.7%, up from 5.6%, and now anticipates beginning rate cuts in the third quarter of 2025, which is a delay from its previous forecast of the second quarter. The bank also projects that inflation will settle within the 1-3% target band by the year’s end.

(Historical Interest Rates,RBNZ)

( NZDUSD Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.